Spend

A key theme running through this blog over the years has been the need for peasants and freedom seekers like us to create and utilise Assets. This pattern of living copies the cleverest of the strategies of the landed gentry, hopefully without aping their sometimes less than caring attitudes towards others.

Without formal education in the ways of money, it can be difficult for a peasant to know how to deal with it, indeed how to get it is a big enough challenge for most of us. The result of that is that most of us can’t afford to wait around and end up with an all consuming job or jobs and we know from some of the money making gurus that JOB stands for Just Over Broke!

The problem that most of us have is related to the lack of knowledge of how money can be put to work for us once we have some, so that we can continue to enjoy it for the long term. Otherwise it’s boom or bust all of the time, with bust being the more common of the two positions.

Assets and Liabilities

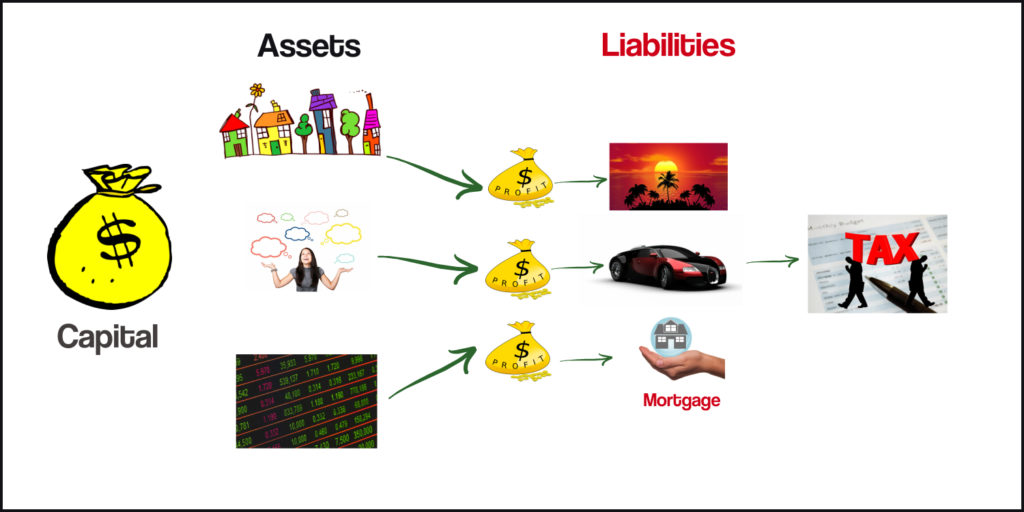

Assets are things you can create or invest in that generate money, such as a rental property, a small business or even intellectual property like a book you’ve written. Assets are created once and generate money many times over without you having to do much in the way of further work. This means of course that you need to spend a little bit of time and effort maintaining the asset, but largely you can leave it to work away generating cash while you think up and create some more.

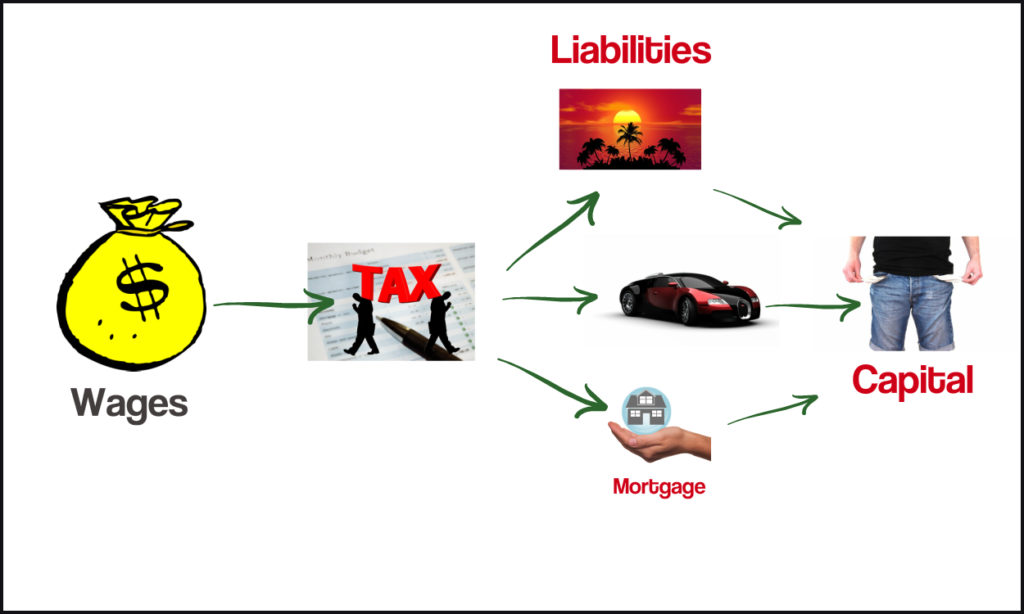

Liabilities on the other hand are things that swallow cash, such as a monthly car payment, a mortgage on your house or credit card debt. Liabilities are doubly troublesome for the waged among us, as the money needed to pay for these cash drains has already been taxed before we get it. This explains the money trap that many peasants like us find ourselves in. There’s no use in moaning about it, the answer lies hidden in plain sight and is being used to great financial effect by the toffs while we complain.

The Trouble with Windfall Assets

So if assets are so great why is it that people who suddenly get lucky and are handed substantial assets such as a lottery win seem to end up miserable and penniless again in a very short time?

The problem for these people is that they fail to grasp or even get advice on the first two points above…the difference between an asset and a liability. Therefore they spend a great deal of their windfall on liabilities such as fancy holidays, cars and other luxuries. The cache of cash (the Capital) they had dwindles as these liabilities have to be paid for every month. These purchases are also for things that lose value overnight; a new car drops its value like a hot potato as soon as it is driven off the garage forecourt, because a great deal of its initial cost was tied up in profit for the dealer and the manufacturer and not a true representation of its material value. In this way, the second owner gets a better deal always. The rich never buy cars, by the way!

How to Spend

All of this means that a big part of financial self education should be to learn how to spend, because as you will have seen, rich people don’t seem to skimp on the luxuries. The main difference is that they spend pre-tax money that has already been generated by an asset i.e. profits. They never spend down the capital.

The Myth of Ownership

When you grow up with nothing much to speak of, when your parents are frequently overheard worrying about money and there’s never anything leftover for holidays or Christmas presents, the lack of a feeling of security is palpable. Due to this, it is common for peasants like us to feel like we need to own stuff when we reach adulthood and to strive to never be in those same situations with our own kids.

This leads a lot of peasants down the garden path to debt and deeper and deeper insecurity, driven by the myth of ownership. But what do I mean by that? Forgive me for being so blunt…see that Range Rover the rich guy just turned up in? He doesn’t own it and what’s more, he doesn’t even have any desire to own it, because it is a tax deductible business expense that he pays a lease for every month from pre-tax profits, but still a liability. To own a luxury car like that, he’d need to dig deep into his Capital reserves and as soon as he drove it home, it would be worth 20% less than he paid for it. So in effect his company rents it for him to use and the money used to pay for it and run it and put fuel in it, is all tax deductible. In other words the money is never taxed!….think about that for a moment.

Next, see that 5 year old Ford your neighbour just drove up in?…he only thinks he owns it, because he pays a monthly car payment for it. By the time he’s paid it up, it will be knackered and he’ll need a new one…he never owns a car either and the payment comes from wages that have already been taxed!

This is the Ownership Myth in action and it applies not only to cars, but also houses, boats, buildings, clothes, fishing tackle and books too…Let me be even blunter here:

Ownership of anything is a Myth…we are all going to die very soon and you know the old saying about taking it with you!

As peasants, if we can get over the Myth of Ownership we can start to make real progress towards a life of freedom.

Financial Education

So the most important thing in gaining freedom while still living in the real world, as opposed to foraging in the woods, is to educate yourself about money and how it really works. I’ve pointed to some resources you can use for this purpose at the end of this post and I highly recommend you get hold of them and start reading.

You and Money

Keep in mind that the rich and the poor have a fundamentally different relationship with money. It’s nothing to do with being clever, just about knowing one simple rule:

The poor work for money, while money works for the rich.

[amazon template=iframe image&asin=B0175P82RA]

[amazon template=iframe image&asin=B0175P5MZU]

Leave a Reply